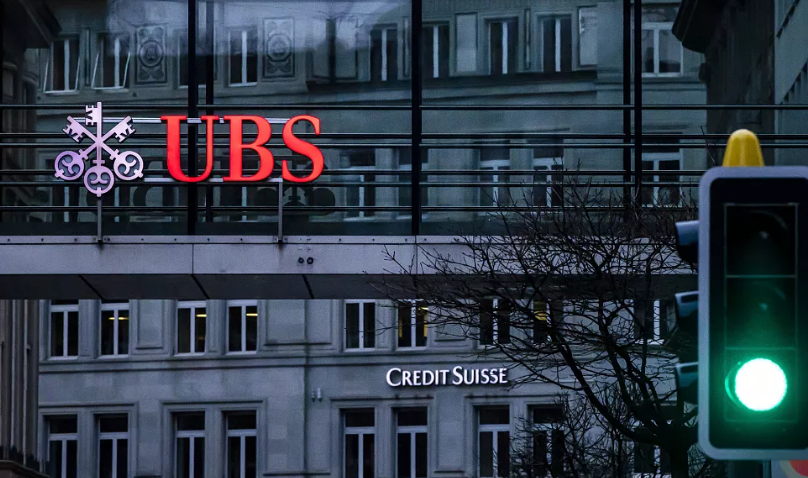

UBS Group AG has agreed to pay $511 million (€452 million) to settle a U.S. Department of Justice investigation into Credit Suisse’s role in helping wealthy Americans evade taxes through offshore accounts. The probe, which began two years ago, predates UBS’s emergency takeover of the embattled lender in 2023.

UBS emphasized it had no role in the misconduct, stating in a release that it maintains “zero tolerance for tax evasion.” The settlement brings closure to one of Credit Suisse’s longest-running legal overhangs and removes a significant obstacle for UBS as it integrates its former rival.

The investigation uncovered that Credit Suisse assisted American clients in concealing more than $4 billion (€3.5 billion) in assets from the Internal Revenue Service (IRS) through at least 475 offshore accounts. According to the Department of Justice, Credit Suisse Services AG pleaded guilty to conspiracy to aid in the filing of false tax returns and will pay $371.9 million (€328.8 million) under that agreement.

Further, the Singapore arm of Credit Suisse entered into a non-prosecution agreement and will pay an additional $138.7 million (€122.6 million) over undeclared U.S.-related accounts it held between 2014 and 2023. These accounts reportedly had assets totaling more than $2 billion.

As part of the settlement, UBS and its subsidiaries must fully cooperate with any ongoing investigations and disclose any further findings related to U.S. taxpayer accounts.

The resolution stems from a 2023 report by the U.S. Senate Finance Committee, which found that Credit Suisse had violated a prior agreement to avoid prosecution by continuing to shield hundreds of millions in assets. Senator Ron Wyden, the committee’s chair, hailed the settlement as a vindication of the Senate’s investigation. “Shady Swiss bankers should not get a free pass while ordinary Americans meet their tax obligations,” he said.

UBS acquired Credit Suisse in March 2023 for CHF 3 billion after the latter collapsed amid mounting losses and long-standing scandals, including earlier allegations of corruption and money laundering. The Swiss government brokered the deal to stabilize the financial system.

Despite a volatile global environment and slower growth, UBS has reported steady progress in integrating Credit Suisse. “We remain on track to substantially complete the integration by the end of 2026,” said UBS CEO Sergio Ermotti. The bank has seen gains in wealth management and investment banking, though its stock has dipped 8% this year amid broader trade tensions.

The settlement is expected to reduce legal uncertainty surrounding UBS and bolster investor confidence as the bank continues its post-merger consolidation.